The following is a basic outline for the CIP/CBI programme as it relates to the island of Saint Lucia. Note that the information and/or fees provided may change periodically, so refer to the following links for the latest, up-to-date information.

https://www.cipsaintlucia.com

https://mcnamaracitizenshipservices.com

https://fostercitizenship.com

The Citizenship by Investment Programme (CIP) of Saint Lucia is an established pathway for global investors to obtain citizenship by making a significant economic contribution to the country. Launched in 2015 and governed by the Citizenship by Investment Act No. 14 of 2015, the program aims to boost Saint Lucia’s socio-economic development while offering investors and their families attractive benefits such as visa-free travel, dual citizenship recognition, and no residency requirements.

A little bit about the island of Saint Lucia

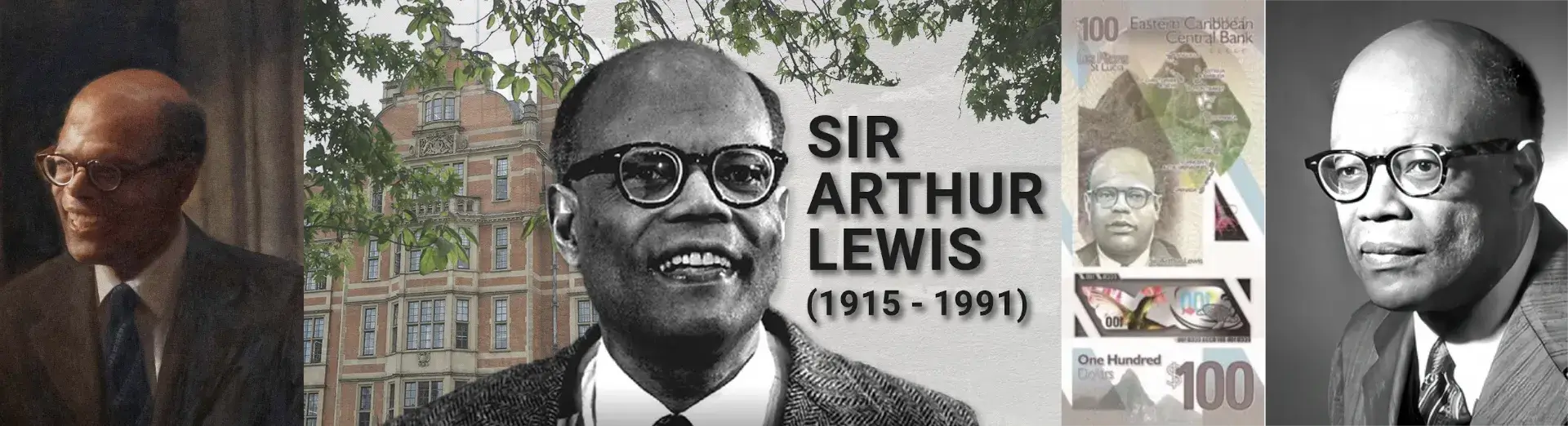

Saint Lucia, also known as the Helen of the West Indies, being the first country to be named after a woman.

Her Capital: Castries

Her Language: English (official)

Total Area: 617 km2

Currency: Eastern Caribbean Dollar (XCD)

Exchange Rate: 1 USD = 2.70 XCD

Est. Population: 179,856 (2024)

Investment Options and Fees

Applicants must be at least 18 years old and can select from the following investment routes:

- National Economic Fund (NEF) Contribution

- A one-time non-refundable donation starting at USD 240,000 for the main applicant and up to three qualifying dependents.

- Additional dependents over 18 cost USD 20,000 each, and under 18 cost USD 10,000 each.

- Approved Real Estate Investment

- Minimum of USD 300,000 invested in government-approved real estate developments such as resorts or boutique hotels.

- Property must be held for at least five years.

- Administrative fees: USD 30,000 for the main applicant, USD 45,000 for applicant with spouse, plus USD 10,000 per additional dependent.

- Enterprise Project Investment

- Option 1: Applicant applying alone: USD 3,500,000

- Option 2: Applicant applying as a joint venture: USD 6,000,000 (each applicant must invest at least USD 1,000,000)

- Option 3: Minimum USD 250,000 investment in approved business projects.

- Administrative fees, approximately USD 50,000 for the main applicant.

- Government Bonds Acquisition

- Investment of at least USD 300,000 in non-interest-bearing government bonds, fully refunded after five years.

- Administrative fee of USD 50,000 applies.

Additional Fees:

- Processing Fee: USD 2,000 for the main applicant, USD 1,000 per dependent.

- Due Diligence Fee: USD 8000 for the main applicant, USD 5,000 per dependent over 16.

- Passport fee: Approximately USD 500 per applicant.

- Adding new dependents post-citizenship is possible for fees such as USD 5,000 for newborn children under 12 months.

Pros of Saint Lucia CIP

- No residency or physical presence requirement.

- Visa-free or visa-on-arrival access to over 140 countries including EU Schengen Area, UK, Hong Kong, and Singapore.

- Allows inclusion of family members including spouse, children under 31, siblings under 18, and parents aged 55+.

- Dual citizenship is recognized.

- Relatively quick processing time. This may vary!

- Multiple investment options catering to different investor preferences.

- Upgraded biometric passports have been issued for enhanced security. The government recently stated that there will be a new 10-year passport option available.

Cons / Considerations

- Some nationalities (e.g., Russia, Belarus, Iran) face restrictions due to due diligence challenges.

- Citizenship is subject to stringent due diligence; problematic backgrounds can lead to rejection.

- Applicants must use licensed agents or lawyers to apply, as direct communication with Citizenship Unit is not permitted.

- The program has faced criticism for being less discriminating compared to other global CIPs, with some concerns about potential misuse.

- Investments, especially in government bonds, require holding periods (five years) before refunds are returned.

Lawyers and Firms Associated

Applicants need legal representation by licensed agents or law firms authorized by the Saint Lucia Citizenship by Investment Unit (CIU). The following list was taken directly from the CIP St Lucia Website:

- Antilia Global Inc.

- Apex Ltd.

- Arton Capital (Saint Lucia) Ltd.

- Blue Marble Citizens Inc.

- Century Capital Inc.

- Citizenship & Corporate Services Ltd. (CCS)

- Corporate Solutions Ltd.

- Foster Citizenship Corporation

- Global Citizenship Services Limited

- Global Citizens Caribbean Inc.

- Global Migration and Investment Services

- McNamara Citizenship Services Inc.

- NTL (Saint Lucia) Ltd.

- Polaris Citizenship & Investment Consultancy Services Ltd.

- Sterling Global Citizenship Advisory Partners Inc.

- TM Antoine Partners Advisory Inc.

- Zen Global Liberty

Lawyers assist applicants by assessing eligibility, preparing authenticated documents, liaising with the CIU, coordinating investments, and supporting during due diligence and post-citizenship processes.

Finally, Saint Lucia’s Citizenship by Investment Programme offers a flexible, relatively affordable option to obtain a second citizenship with the benefits of increased global mobility and family inclusion. Investors can choose among donation, real estate, enterprise, or government bond investment options. The program highlights secure application procedures backed by thorough due diligence, modern biometric passports, and investor-friendly enhancements such as online processing and expanded dependent inclusion. However, working with experienced licensed lawyers or firms is essential to navigate the application and investment steps effectively.

Saint Lucia CIP remains one of the fastest and most accessible Caribbean economic citizenship programs, making it an attractive choice for investors seeking second citizenship and enhanced travel freedom while contributing to the country’s economic growth.